Arlington Venture Capital Roundup Q2 2022

August 10, 2022 | By Adam Henry

While Q2 2022 showed some headwinds in venture capital raises and the IPO market, Arlington-based companies continued to raise venture capital at a steady rate to launch and grow their innovative products and services.

In total, Arlington-based companies saw eight venture capital raises totaling $166 million in funding. This represents a 60% increase in deal count and a 29% increase in funding from Q1 2022.

Notable raises from this quarter include:

- Arlington-based Federated Wireless, a provider of shared spectrum and CBRS technology, raised an additional $14 million in Series D funding to help scale the company’s platform and support further investments in its capabilities and partnerships, bringing the total raised in the round to $72 million.

- Ryse Health, an Arlington-based startup that provides care offerings to diabetes patients, raised $3.4 million in seed funding to hire more employees and expand its service into new markets.

- OxiWear, an Arlington-based health tech startup, secured $70,000 from Halcyon Angels, an early-stage investing network from Washington, D.C. social impact nonprofit Halcyon. That comes not long after OxiWear collected its second $100,000 investment from the nonprofit’s separate Halcyon Fund.

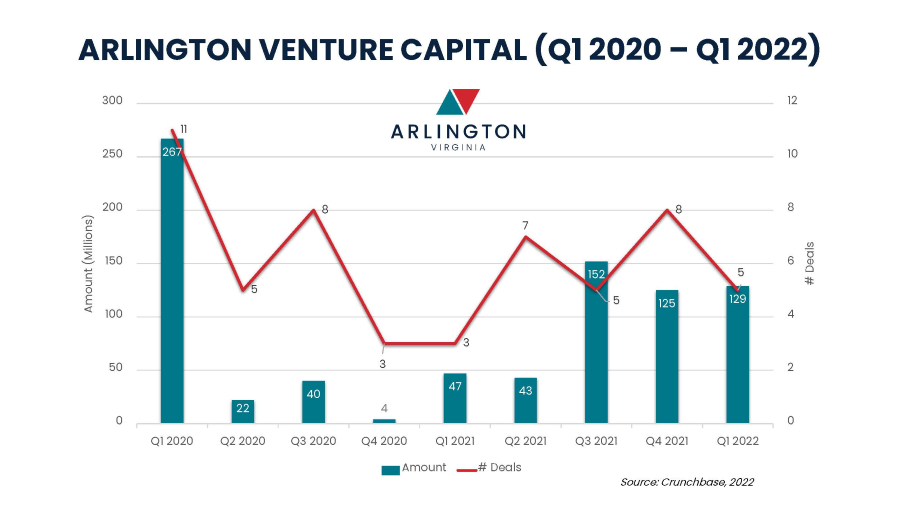

Since Q2 2020, Arlington-based companies have raised $995.2 million in venture capital across 63 deals. From Q3 2021 to Q2 2022, Arlington-based companies have averaged $143 million in venture capital raises per quarter.

Looking at the North American landscape of venture capital, Q2 2022 saw a decrease in deal count from Q1 2022. According to the National Venture Capital Association’s Pitchbook-NVCA Venture Monitor, the US venture capital ecosystem in Q2 2022 saw a total of 3,374 deals, a 24.5% decrease from the 4,467 deals logged in Q1 2022. Further, the top four markets in the US (Bay Area, New York, Los Angeles and Boston) have captured 68% of deal value through the first two quarters of 2022. Metro D.C. has logged a total of 230 venture capital deals totaling $2.3 billion thus far in 2022.

While global economic trends in inflation, supply chain, tightening labor markets and predictions of a possible recession show signs of affecting the venture capital and big tech industries, Arlington-based companies continue a steady trend in venture capital. This is a testament to our community and regional strength in innovation and talent to spin out new products and services.