Do I Really Need an Arlington Business License? Absolutely!

July 26, 2023

Anyone who runs or is looking to open a business in Arlington, needs to have a business license. With only a few exceptions, all Arlington business owners need to get a business license — and maintain that license — year after year. This includes businesses of all types and sizes. If you’re a freelance artist, operate a nonprofit, own a retail establishment or restaurant, operate as a consultant or run a home-based business, you are required to have an Arlington Business License in order to legally operate in the County. In this short video, BizLaunch Director Tara Palacios explains the licensing and permitting process for a new business.

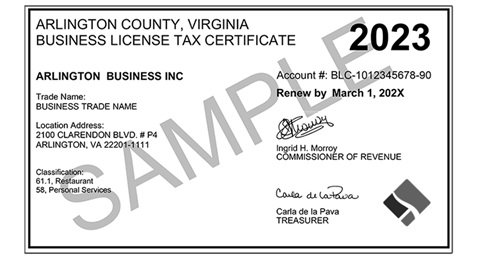

Obtaining a business license is pretty simple. The Arlington Commissioner of Revenue issues business licenses every year and assesses the amount of tax businesses are required to pay. The entire process can be done online via the Customer Assessment and Payment Portal (CAPP). Simply go to the website and click on “Register a new business/location.” Be sure to have your Employer Identification Number (EIN) or Social Security Number (SSN) as well as your home occupation permit or Certificate of Occupancy (CO) number handy, as you will need those to complete the application.

Once you've completed your business license application, click submit. A business tax inspector will review your application and , once approved, e-mail you a confirmation. That's it!

As you may have guessed, a business license serves as the taxing mechanism for both the Business License Tax, which is based on the gross receipts of a business, and the Business Tangible Personal Property Tax, which is based on the individual tangibles, or personal assets, of a business. (Business tangibles are things like furniture, machinery, tools or programmable computer equipment.)

We all know that no one is ever excited about the prospect of additional taxes, so why is having a license so important? It’s important because the tax revenue it generates helps fund Arlington’s many amenities, like public transportation, social services, public art, parks, community centers and bike trails. These amenities are what attract customers to Arlington and doing business with you. But perhaps even more important, having a license protects you. If a business is found to be operating without a license, the owner can be fined and/or sent to court for each day of operation without a required license. The BizLaunch team wants to protect you by ensuring you are operating in full compliance with the law.

All of the various licenses, taxes and fees can be overwhelming, especially at the beginning, but BizLaunch and the Arlington Commissioner of Revenue are here to help. The BizLaunch team recommends you start by familiarizing yourself with the How to Start a Small Business Checklist as it covers each step in the process, including explaining licensing and permitting regulations and the Arlington Commissioner of Revenue’s Office provides a straight-forward guide to the license and tax requirements for new businesses opening in Arlington.

Regardless of where you are in the process, please don't try to go it alone. Reach out to BizLaunch or the Arlington Commissioner of Revenue office. Talking to staff early in the process can ultimately save you time and help you avoid mistakes.